Will Visa Stock Split Again 2018

Sezeryadigar/E+ via Getty Images

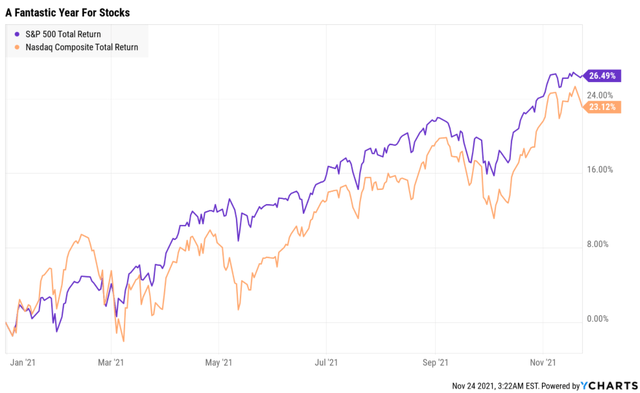

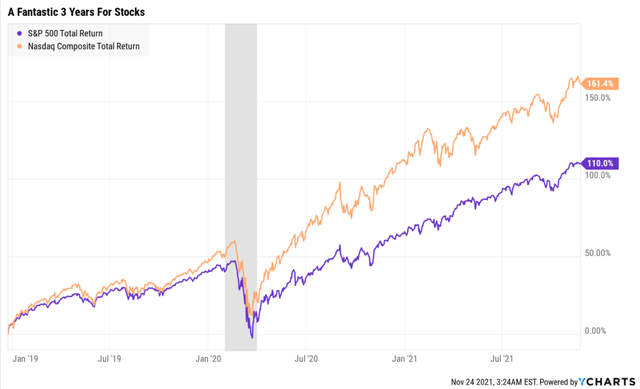

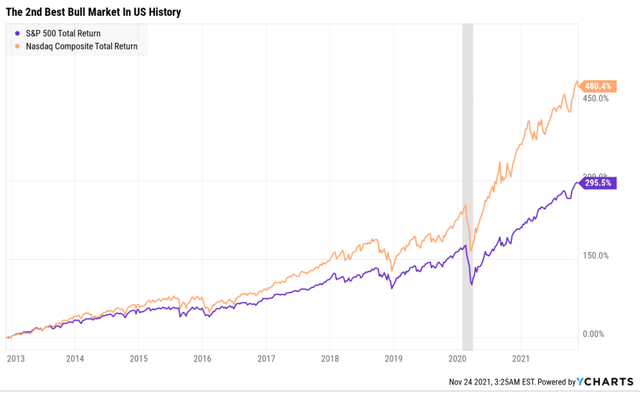

Are you worried about this overvalued stock market? After the epic run the market has been on over the concluding few years, or fifty-fifty decade, a lot of investors are.

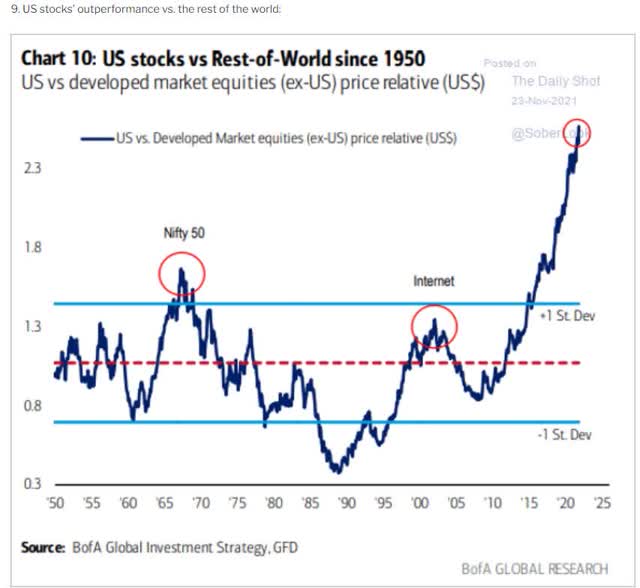

Are stocks overvalued? Admittedly, especially compared to foreign peers.

Compared to the rest of the earth, US stocks are the most overvalued in the concluding 71 years.

Compared to the rest of the earth, US stocks are the most overvalued in the concluding 71 years.

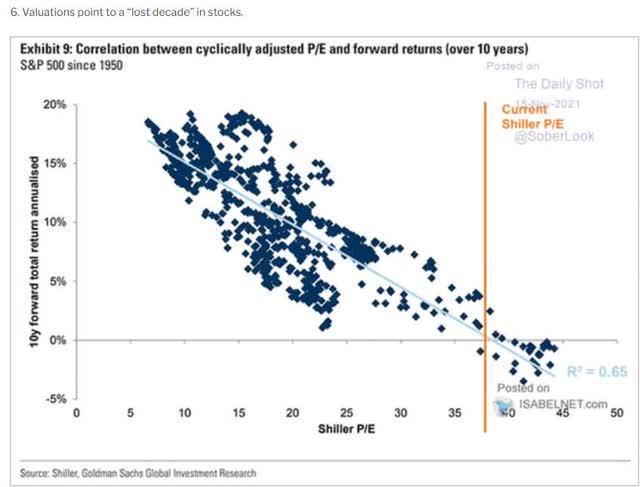

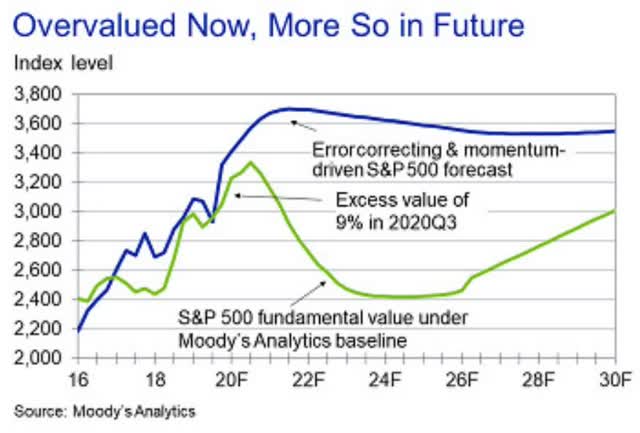

Goldman thinks that the Due south&P is potentially headed for a lost decade. Moody'due south agrees.

Goldman thinks that the Due south&P is potentially headed for a lost decade. Moody'due south agrees.

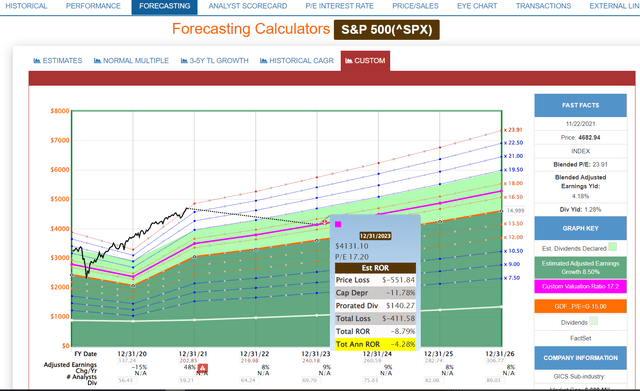

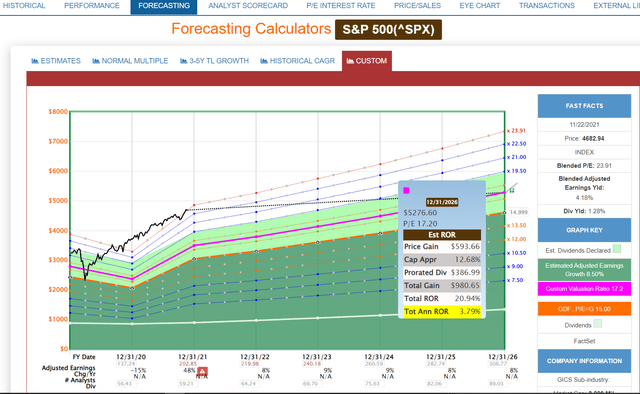

The good news for investors is that FactSet and JPMorgan don't wait a lost decade for the market. They gauge the market place to be about 30% historically overvalued and thus likely to deliver weak returns over the next five years.

The good news for investors is that FactSet and JPMorgan don't wait a lost decade for the market. They gauge the market place to be about 30% historically overvalued and thus likely to deliver weak returns over the next five years.

S&P 500 2023 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research)

(Source: FAST Graphs, FactSet Research)

S&P 500 2026 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Enquiry)

(Source: FAST Graphs, FactSet Enquiry)

Analysts expect the S&P 500 to deliver about 21% full returns over the side by side five years.

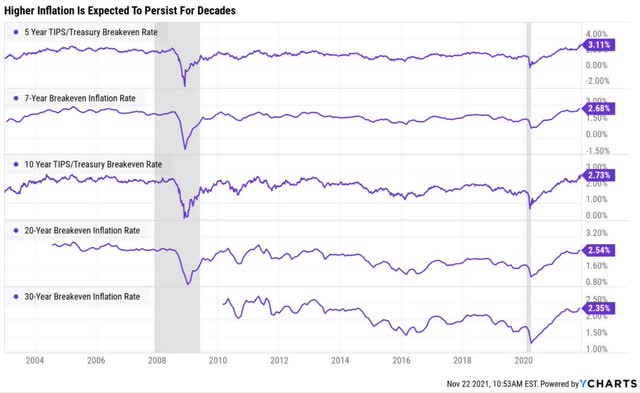

Aggrandizement And Run a risk-Adjusted Expected Returns

Year Upside Potential By End of That Year Consensus CAGR Render Potential Past End of That Year Probability-Weighted Return (Annualized) 2021 -24.86% -87.08% -65.31% -68.31% 2022 -17.08% -15.17% -eleven.38% -fourteen.38% 2023 -8.00% -3.82% -2.87% -5.87% 2024 ane.twoscore% 0.44% 0.33% -two.67% 2025 11.60% ii.69% ii.02% -0.98% 2026 22.67% 4.06% 2.89% -0.25%

(Source: DK Southward&P 500 Valuation And Total Return Tool) updated weekly

Adjusted for inflation, the risk-expected returns of the South&P 500 are nearly zero for the next 5 years.

So not a lost decade, but potentially a lost three to v years, depending on whether you gene in inflation.

Then what's the answer? Sell everything and hide in greenbacks?

Over the long-term cash is 100% guaranteed to lose value.

Over the long-term cash is 100% guaranteed to lose value.

- over the adjacent 30 years, the bond market expects cash to deliver -51% returns

How virtually foreign companies which are likely to see strong mean reversion outperformance at some betoken?

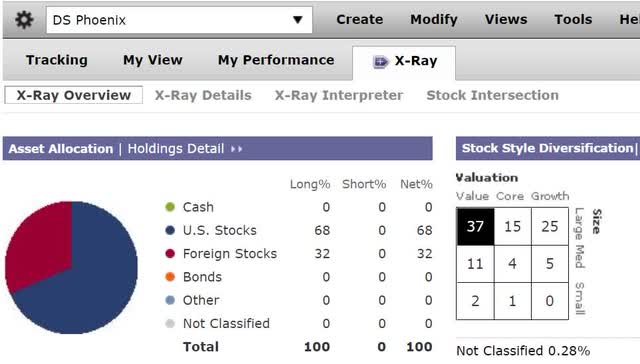

(Source: Morningstar)

My retirement portfolio is 32% foreign companies, mostly deep value names that are poised to soar in the coming years.

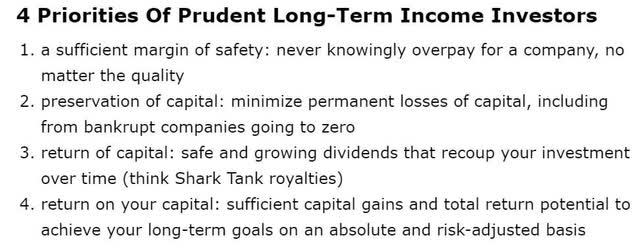

But what if you are a Us-focused dividend growth investor wanting to safely purchase the world'due south highest quality companies. Not just to protect yourself from inflation today, simply to help y'all retire rich tomorrow and stay rich in retirement no affair what the market or economy does in the futurity?

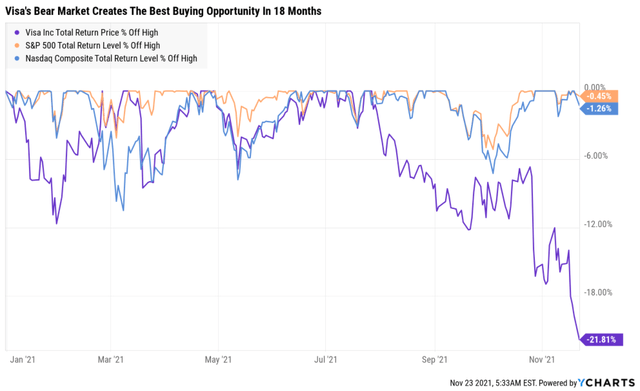

In this red hot market Visa (NYSE:V), which is equally close to a perfect quality hyper-growth dividend blue-fleck, is down 22%.

Is the thesis broken? Is Visa a "falling knife" that investors should avoid similar the plague?

Analyst Median 12-Month Price Target Morningstar Fair Value Estimate Discount To Cost Target (Non A Fair Value Approximate) Discount To Off-white Value Upside To Toll Target (Not Including Dividend) Upside To Fair Value (Not Including Dividend) 12-Month Median Total Return Cost (Including Dividend) Fair Value + 12-Month Dividend Discount To Full Price Target (Not A Fair Value Estimate) Discount To Fair Value + 12-Month Dividend Upside To Toll Target ( Including Dividend) Upside To Off-white Value + Dividend

$274.38 $217 (DCF model = 31.1 PE) 28.72% nine.87% 40.29% ten.95% $275.88 $218.50 29.11% ten.49% 41.06% eleven.72%

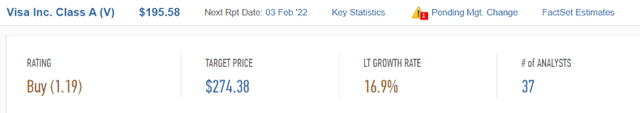

Analysts wait Visa to more than than quadruple the market'due south returns in the next 21 months.

Frontwards Overvaluation Forecast (12 Months From At present)

12-Month Frontwards S&P Bottom-Up Consensus 5142.95 Forward PE Forecast (12 Months From Now) 12-Calendar month Consensus Marketplace Render Potential 9.8% 21.63 28.7%

(Source: DK S&P 500 Valuation & Full Render Tool)

We don't really care most 12-month cost targets, which never accept whatsoever basis in our recommendations. What nosotros care well-nigh are the fundamentals that ultimately drive 91% of long-term returns.

Total Returns Explained By Fundamentals/Valuations

Time Frame (Years) 1 Twenty-four hour period 0.02% 1 calendar month 0.iv% 3 month one.25% 6 months ii.five% 1 5% two 16% three 25% 4 33% v 41% half-dozen 49% 7 57% 8 66% 9 74% x 82% eleven+ xc% to 91%

(Sources: DK S&P 500 Valuation And Total Render Potential Tool, JPMorgan, Banking company of America, Princeton, RIA)

- over 12 months luck is 20X equally powerful every bit fundamentals

- over eleven+ years fundamentals are 11X as powerful as luck

Well so my friends, allow me tell you five reasons why you should potentially buy Visa (Five) now before everyone else does.

In fact, these five reasons brand Visa a classic Buffett-fashion "Wonderful visitor at a fair price" and could exist only what you lot demand to help your portfolio accept a great 2022 and across.

Reason One: This Bear Market place Is A Potentially Wonderful Buying Opportunity

First, let'south accost why Visa has fallen 22% in a matter of weeks as the market makes record high later record loftier.

Amazon announced information technology volition end accepting Visa credit cards issued in the U.1000. starting in late Jan 2022, citing its belief that fees on these cards are too loftier. Consumers will nonetheless be allowed to use U.K.-issued Visa debit cards. Merchants and the networks take argued for many years over interchange fees, and it is typically large merchants that atomic number 82 the charge. At this point, this looks like merely another skirmish in this long-running battle, although refusing to take specific cards is an farthermost step. Following Brexit, the networks were no longer constrained past European union regulations on U.K. cross-edge transactions and raised their fees. The networks typically collect a very large premium for cantankerous-border transactions relative to domestic transactions, but intra-Europe cantankerous-edge transactions are priced similarly to domestic transactions. With both networks raising fees, it is not obvious why Visa has been singled out, although nosotros believe Amazon may have a stronger relationship with Mastercard in the U.K or considered declining cards from both networks to be a stride too far. At this point, the conclusion of this outcome remains uncertain, although the companies accept until January 2022 to piece of work out a solution. If they don't, nosotros don't believe the loss of volume would be fabric relative to Visa's overall business and believe this announcement would only be pregnant if it prompted other retailers to follow adapt. Only nosotros consider this unlikely. Nosotros will maintain our $217 fair value gauge and wide moat rating for Visa." - Morningstar (accent added)

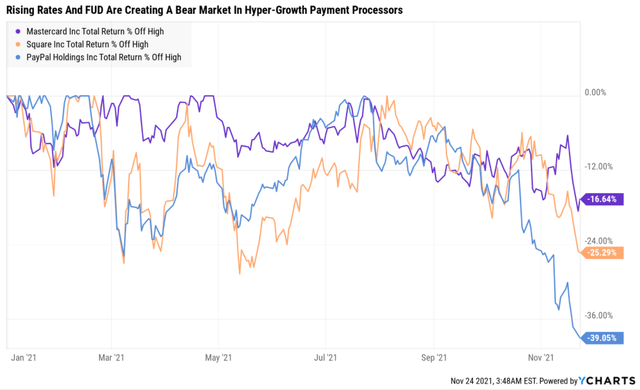

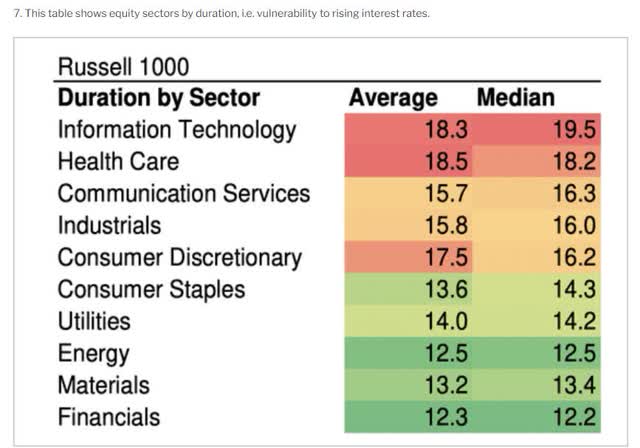

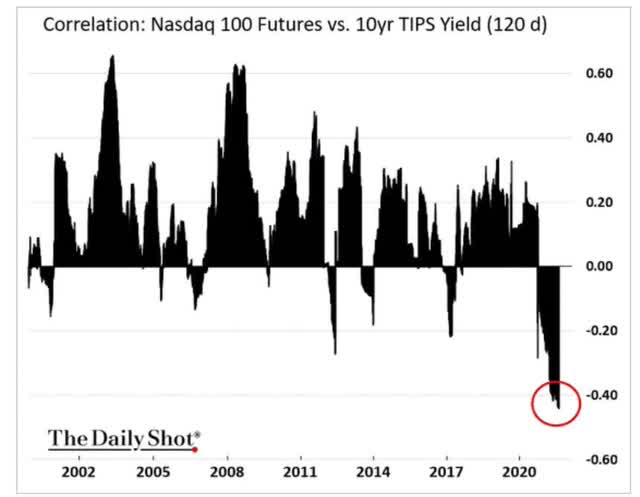

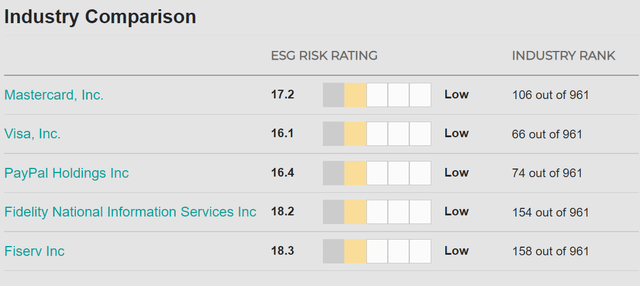

Payment processors in general, ranging from Mastercard (MA), Paypal (PYPL), and Foursquare (SQ) have all been suffering due to rising interest rates and concerns about potential industry disruption.

In the take chances section, I'll explain why these companies are adapting to the rise of disruptive threats like Blockchain and Buy-Now-Pay Subsequently, but another reason for their sharp sell-off is rising interest rates.

(Source: Daily Shot)

(Source: Daily Shot)

Faster growing companies tend to be the most rate-sensitive and that's never been more than true at today'southward loftier valuations for growth stocks.

In other words, high valuations combined with ascension rates and now something scary happening in the headlines is the likely reason why payment processors similar Visa accept sold off so sharply.

In other words, high valuations combined with ascension rates and now something scary happening in the headlines is the likely reason why payment processors similar Visa accept sold off so sharply.

2025 Consensus

Metric 2020 Growth 2021 Growth Consensus 2022 Growth Consensus 2023 Growth Consensus 2024 Consensus Sales -five% 10% 17% 14% 12% 10% Dividends 20% 7% 17% (Official) viii% nineteen% 24% EPS -seven% 17% 20% 19% 16% 29% Owner Earnings (Buffett smoothed out FCF) -18% NA NA NA NA NA Operating Cash Flow -17% 24% 16% 8% 29% 25% Free Greenbacks Flow -18% 52% fifteen% 16% NA NA EBITDA -5% -4% 20% 16% 14% 14% EBIT (operating income) -six% -three% 19% xvi% 16% thirteen%

(Source: FAST Graphs, FactSet Research)

Analysts, rating agencies, and the bond marketplace all agree, that Visa's long-term thesis remains intact.

This is NOT a "falling knife" value trap, whose fundamentals are falling every bit fast or faster than the stock price.

In fact, let me show you just how not broken Visa'south thesis really is.

Reason 2: Visa Is One Of The World'due south All-time Companies

The Dividend King's overall quality scores are based on a 220 point model that includes:

-

dividend safety

-

balance sheet strength

-

credit ratings

-

credit default swap medium-term bankruptcy run a risk data

-

short and long-term bankruptcy hazard

-

accounting and corporate fraud risk

-

profitability and business organisation model

-

growth consensus estimates

-

cost of capital

-

long-term risk-management scores from MSCI, Morningstar, FactSet, Southward&P, Reuters'/Refinitiv and Simply Majuscule

-

management quality

-

dividend friendly corporate culture/income dependability

-

long-term full returns (a Ben Graham sign of quality)

-

analyst consensus long-term return potential

Information technology really includes over i,000 metrics if yous count everything factored in past 12 rating agencies nosotros utilize to assess primal take chances.

-

credit and hazard direction ratings make up 38% of the DK safety and quality model

-

dividend/balance canvass/risk ratings make up 79% of the DK safety and quality model

How practice nosotros know that our safety and quality model works well?

During the two worst recessions in 75 years, our safe model predicted 87% of baddest dividend cuts during the ultimate baptism by burn for any dividend condom model.

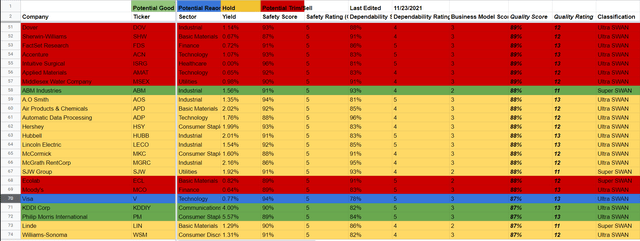

How does Visa score on one of the world's about comprehensive and authentic safety models?

Dividend Safety

Estimate Dividend Cut Risk In Pandemic Level Recession

Rating Dividend Kings Safety Score (133 Betoken Prophylactic Model) Guess Dividend Cut Risk (Boilerplate Recession) 1 - unsafe 0% to 20% over 4% xvi+% 2- below average 21% to 40% over two% eight% to sixteen% iii - average 41% to 60% 2% 4% to eight% iv - prophylactic 61% to eighty% 1% 2% to 4% 5- very safe 81% to 100% 0.five% 1% to 2% 5 94% 0.l% 1.30%

Long-Term Dependability

Company DK Long-Term Dependability Score Interpretation Points Non-Undecayed Companies 18% or beneath Poor Dependability i Depression Dependability Companies nineteen% to 57% Below-Average Dependability 2 S&P 500/Industry Average 58% (58% to 67% range) Average Dependability 3 Above-Average 68% to 77% Very Dependable 4 Very Good 78% or college Exceptional Dependability v V 78% Exceptional Dependability 5

Overall Quality

5 Final Score Rating Safety 93% 5/five very safe Business Model 90% three/3 wide moat Dependability 78% 5/5 exceptional Total 87% thirteen/13 Ultra SWAN

Visa: 69th Highest Quality Principal Listing Company (Out of 507) = 86th Percentile

(Source: DK Rubber & Quality Tool) updated daily, sorted past overall quality

(Source: DK Rubber & Quality Tool) updated daily, sorted past overall quality

The DK 500 Primary List includes the earth's highest quality companies including:

-

All dividend champions

-

All dividend aristocrats

-

All dividend kings

-

All global aristocrats (such every bit BTI, ENB, and NVS)

-

All 13/13 Ultra Swans (as close to perfect quality every bit exists on Wall Street)

- 42 of the world's all-time growth stocks (on its way to 50)

Visa's 87% quality score means its similar in quality to such blue-chips as

- Linde (LIN) - dividend aristocrat

- Philip Morris International (PM) - dividend king

- Ecolab (ECL) - dividend aristocrat

- McCormick (MKC) - dividend aristocrat

- Automatic Information Processing (ADP) - dividend blueblood

- Air Products & Chemicals (APD) - dividend aristocrat

- A.O Smith (AOS) - dividend aristocrat

- Dover (DOV) -dividend king

Even among the globe's highest quality companies, Visa is college quality than 86% of them.

What makes Visa then safety and dependable?

Visa Credit Ratings

Rating Agency Credit Rating 30-Twelvemonth Default/Bankruptcy Gamble Gamble of Losing 100% Of Your Investment 1 In Due south&P AA- stable 0.55% 181.viii Moody's Aa3 (AA- equivalent) stable 0.55% 181.8 Consensus AA- stable 0.55% 181.8

(Sources: Due south&P, Moody'south)

How about a 0.55% primal adventure of losing all your money in the next 30 years?

Visa Leverage Consensus Forecast

Interest Coverage (viii+ Safe)

Yr Debt/EBITDA Net Debt/EBITDA (three.0 Or Less Safe Co-ordinate To Credit Rating Agencies) 2020 i.62 0.27 27.32 2021 1.25 0.15 31.21 2022 1.00 -0.05 37.50 2023 0.85 -0.19 44.31 2024 0.81 -0.52 59.49 Annualized Change -xv.86% NA 21.48%

(Source: FactSet Research)

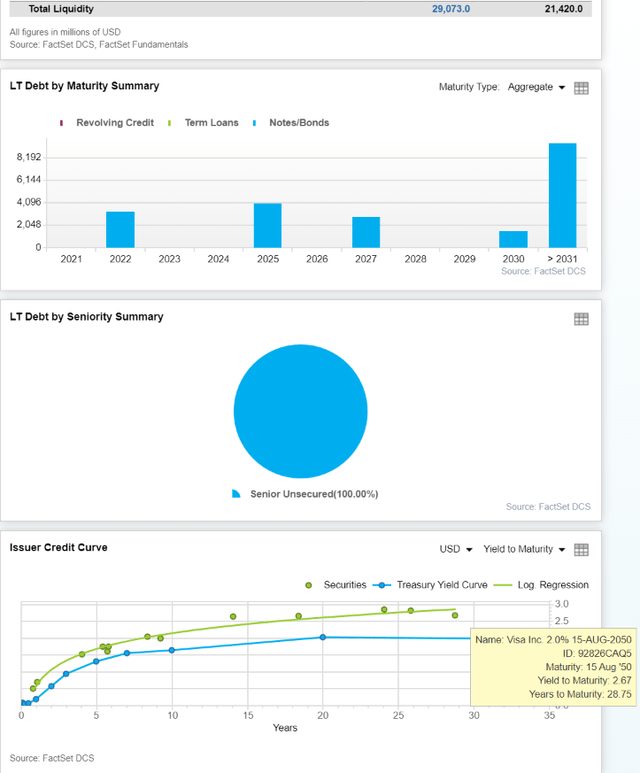

How near a balance sheet that is expected to have more greenbacks than debt past 2022?

Visa Balance Sheet Consensus Forecast

Year Total Debt (Millions) Greenbacks Net Debt (Millions) Interest Toll (Millions) EBITDA (Millions) Operating Income (Millions) Interest Costs 2020 $24,070 $16,289 $4,029 $516 $14,864 $14,098 two.14% 2021 $20,977 $sixteen,487 $2,465 $513 $xvi,780 $16,013 2.45% 2022 $19,890 $nineteen,199 -$1,072 $512 $19,872 $19,202 2.57% 2023 $19,529 $20,147 -$4,311 $503 $22,948 $22,288 2.58% 2024 $20,977 $41,044 -$xiii,401 $426 $25,845 $25,344 2.03% 2025 NA NA NA NA $28,316 $27,419 NA Annualized Growth -3.38% 25.99% NA -4.68% 13.76% fourteen.23% -1.34%

(Source: FactSet Research)

How about double-digit cash catamenia growth and a cash position that's already $16.5 billion and growing at 26% per twelvemonth?

Visa Bond Contour

(Source: FactSet Enquiry)

The smart money on Wall Street is so confident in Visa'southward business it's willing to lend to it for 29 years at 2.7%.

Today Visa's borrowing costs are 2.39% and are expected to fall to 2% inside a few years.

- adapted for the bond market'due south long-term 2.35% aggrandizement expectations Visa is borrowing for gratis

- and investing that money at a cash return on invested uppercase of 25%

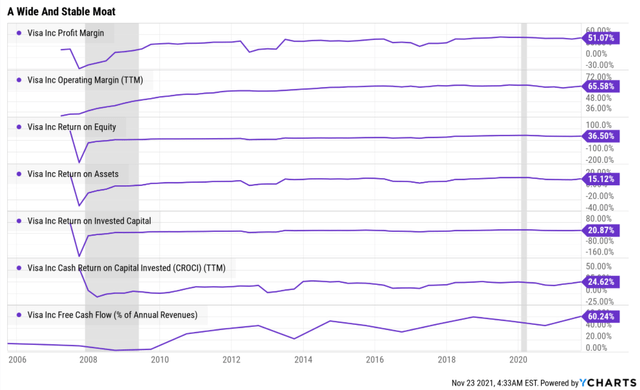

Speaking of profitability, that'due south Wall Street's favorite proxy for quality and Visa'south is merely amazing.

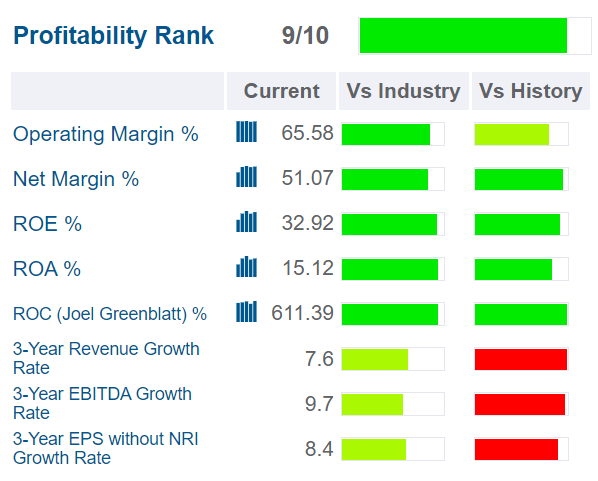

Visa Profitability: Wall Street'due south Favorite Quality Proxy

(Source: GuruFocus Premium)

Payment processing is a highly lucrative industry and Visa's profitability is historically in the top x% of its peers.

Visa Trailing 12-Month Profitability Vs Peers

Metric Manufacture Percentile Major Credit Processors More Assisting Than V (Out Of 371) Operating Margin 87.06 48 Net Margin 84.76 57 Return On Equity 93.31 25 Return On Assets 94.90 NA Render On Capital 94.61 20 Boilerplate 90.93 34

(Source: GuruFocus Premium)

In the last year information technology's in the top 9% of its peers.

Visa's gratuitous cash flow margins are in the top ane% of all companies on earth.

Its net profit margins of over 50% are the stuff of legend.

Visa Margin Consensus Forecast

Return On Capital Forecast

Twelvemonth FCF Margin EBITDA Margin EBIT (Operating) Margin Net Margin Render On Capital letter Expansion 2020 46.3% 68.0% 64.5% 51.ii% 1.04 2021 sixty.2% 69.6% 66.4% 53.7% TTM ROC 611.39% 2022 56.viii% seventy.3% 68.0% 53.3% Latest ROC 652.threescore% 2023 56.four% 71.0% 68.9% 54.7% 2025 ROC 635.fifteen% 2024 58.6% 71.4% lxx.1% 55.7% 2025 ROC 677.96% 2025 57.3% 71.3% 69.0% 54.8% Average 656.55% 2026 NA NA NA NA Manufacture Median 64.88% Annualized Growth 4.34% 0.93% 1.35% 1.37% Visa/Peers 10.12 Vs S&P 50.50

(Source: FactSet Inquiry)

Over the coming years, analysts look Visa'due south profitability to rise even farther, despite all the various risks its facing from industry disruptors.

And as far equally return on capital goes, Joel Greenblatt'southward gold standard proxy for quality and moatiness? Visa's ROC is over 600% and is expected to remain stable over fourth dimension, at 10X college than its peers and 51X higher than the S&P 500.

Joel Greenblatt delivered twoscore% annualized returns for 21 years at Gotham Uppercase focusing purely on quality and valuation. And according to ane of the greatest investors in history, Visa is one of the highest quality companies on earth.

Reason Iii: Visa's Hyper-Growth Thesis Remains Firmly Intact

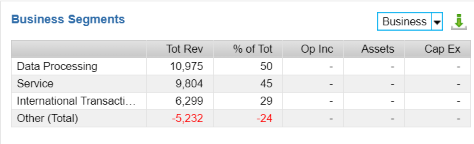

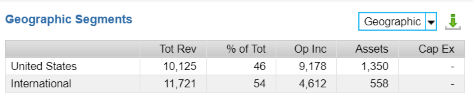

Visa was founded in 1958 in San Francisco and is the world's largest credit card processing network.

Visa is the largest payment processor in the globe. In fiscal 2020, it processed almost $9 trillion in purchase transactions. Visa operates in over 200 countries and processes transactions in over 160 currencies. Its systems are capable of processing over 65,000 transactions per second...

Visa traces its roots back to the issuance of the first Banking company of America cards in the belatedly 1950s. As credit cards grew, partnerships betwixt credit card issuers became necessary, and Visa equally a make was formed in 1976. In the decades since, Visa has been i of the largest beneficiaries of the shift toward electronic payments. In financial 2020, the company processed almost $9 trillion in purchase transactions. Visa has almost 16,000 financial institution partners, 3.4 billion Visa cards in circulation, and over 50 1000000 merchants accepting Visa.

According to the Nilson Report, Visa holds over 50% marketplace share (by purchase volume) in the U.S., Europe, Latin America, and the Centre East/Africa. Visa also processes roughly twice as many transactions as its closest competitor, Mastercard. Simply put, Visa's position in the world of electronic payments is unparalleled. We don't believe that building a new network with a comparable size and reach is realistic over any foreseeable fourth dimension line, and view Visa's position within the electric current global electronic payment infrastructure as substantially unassailable." - Morningstar (accent added)

Morningstar considers their moat "essentially unassailable". I wouldn't go that far merely with over 50 million merchants on its network and $11.4 trillion in processing volumes in the last fiscal year, information technology'due south a very wide moat company indeed.

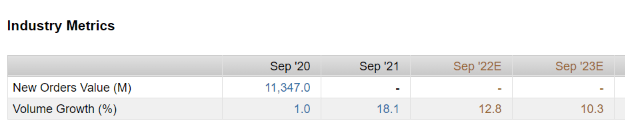

(Source: FactSet Research)

For context, FactSet'south $11.35 trillion in transactions in 2020 represents approximately 11% of global Gdp.

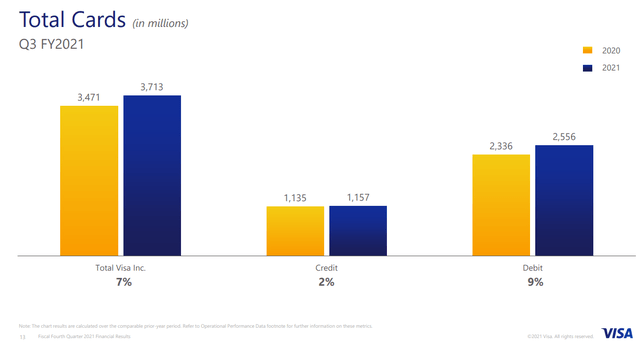

(Source: earnings presentation)

Visa is upwardly to iii.seven billion cards in global circulation, growing at 7% in the past twelvemonth. And with nearly 85% of all global transactions nonetheless in cash, at that place is plenty of growth runway left for Visa.

How much?

Visa Medium-Term Consensus Forecast

Year Sales Free Cash Flow EBITDA EBIT (Operating Income) Net Income 2020 $21,846 $ten,120 $14,864 $14,098 $11,193 2021 $24,105 $14,522 $xvi,780 $xvi,013 $12,933 2022 $28,258 $sixteen,040 $xix,872 $19,202 $15,069 2023 $32,337 $18,234 $22,948 $22,288 $17,687 2024 $36,173 $21,195 $25,845 $25,344 $20,144 2025 $39,731 $22,757 $28,316 $27,419 $21,790 Annualized Growth 2020-2025 12.71% 17.59% thirteen.76% 14.23% xiv.25%

(Source: FactSet Research)

In simply the next few years analysts expect Visa's gratis cash flow to grow at nearly 18% annually.

Its dividend is expected to grow by about 16% per year and EPS by eighteen%.

Visa Dividend Growth Consensus Forecast

Year Dividend Consensus Earnings/share Consensus Payout Ratio Retained Earnings Buyback Potential Debt Repayment Potential 2021 $ane.28 $5.91 21.7% $10,107 two.43% 48.two% 2022 $1.44 $7.03 xx.5% $12,203 ii.93% 58.2% 2023 $i.55 $8.44 18.4% $15,041 iii.62% 75.6% 2024 $ane.85 $9.82 eighteen.8% $17,399 4.18% 89.ane% 2025 $2.30 $11.48 20.0% $20,040 4.82% 95.5% Total 2021 Through 2025 $8.42 $42.68 19.seven% $74,789.58 17.98% 356.53% Annualized Rate fifteen.78% xviii.06% -1.93% 18.66% 18.66% 18.66%

(Source: FactSet Research)

- 60% or less is the safe payout ratio for this manufacture

- Visa historically runs ane/3 that

- 16% dividend growth only 18% earnings growth resulting in a very safe dividend

- plenty retained earnings to repay 357% of its debt or buyback 18% of its shares

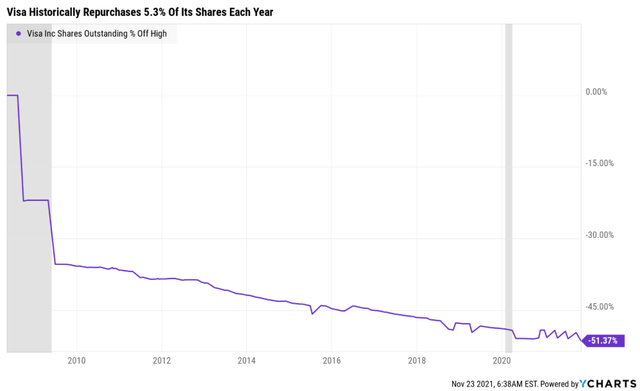

How much practice analysts wait Visa to spend on buybacks?

- $thirty.87 billion between 2021 and 2023

- 7.four% of shares over three years

- 2.4% of shares each year

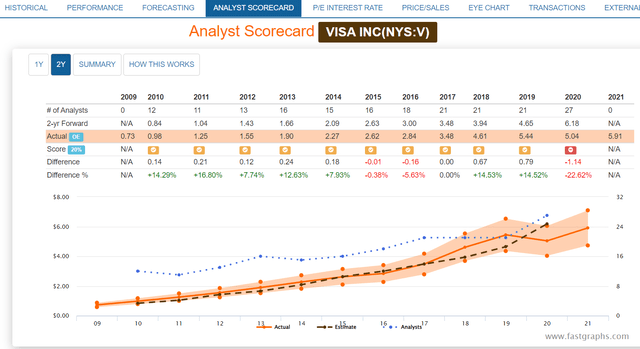

What about the long-term?

Visa Long-Term Growth Outlook

(Source: FactSet Research)

- 16.1% to 17.7% CAGR growth consensus range

- smoothing for outliers v% margin of error to the downside and fifteen% to the upside

- 15% to 21% CAGR historical margin-of-error adapted growth consensus range

(Source: FAST Graphs, FactSet Research)

Visa is expected to keep growing at the same rate as the last decade. A rate that's approximately 2X every bit fast as the S&P 500'southward profits are expected to abound.

OK, so nosotros have one of the world's all-time companies, growing at nearly 17% according to analysts, even with the recent Amazon news, and a 22% conduct marketplace.

That means that Visa, for the showtime fourth dimension in nearly 18 months, is now reasonably valued. In fact, it'due south a classic Buffett-style "wonderful company at a off-white price".

Reason Four: A Classic Buffett-Manner "Wonderful Company At A Fair Price"

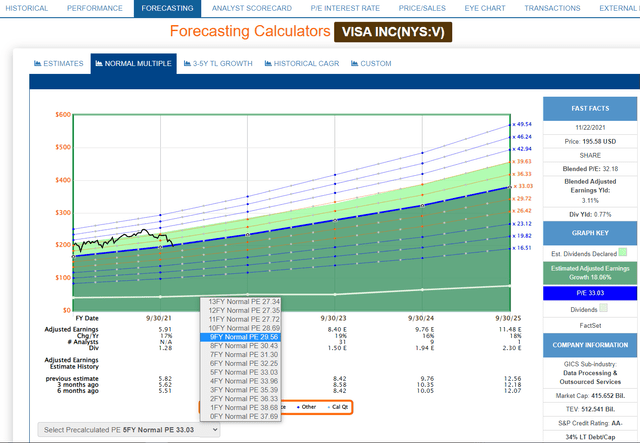

I don't speculate about what a visitor is worth. I just permit the market, over the long-term tell me what a blueish-chips quality, chance contour, and growth prospects are worth.

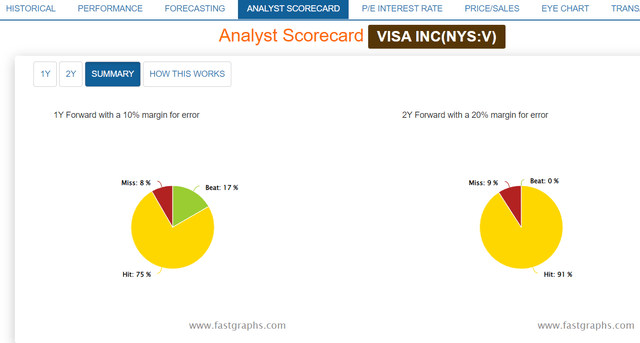

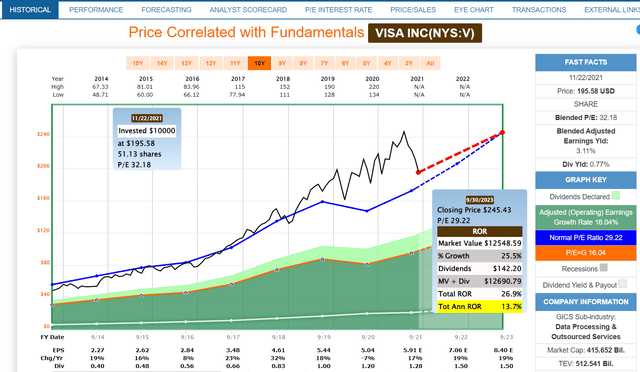

(Source: FAST Graphs, FactSet Research)

Since its IPO hundreds of millions of investors have paid betwixt 27.5X and 31.5X earnings for Visa.

- a 90% statistical probability that is range represents the company'south intrinsic value

Discount To Off-white Value Current Forward PE

Metric Historical Fair Value Multiples (10-Years) 2021 2022 2023 2024 2025 12-Month Forward Fair Value 13-Year Median P/S xiii.05 $147.47 $173.57 $198.36 $221.85 $244.04 5-Year Boilerplate Yield 0.63% NA $238.x $246.03 $293.65 $365.08 thirteen-Year Median Yield 0.63% $238.x $238.ten $246.03 $293.65 $365.08 xiii-year Average Yield 0.69% $217.39 $217.39 $224.64 $268.12 $333.33 Earnings 29.22 $172.67 $206.73 $246.01 $286.94 $335.45 Operating Greenbacks Menstruum 31.46 $183.33 $213.20 $229.49 $347.63 $429.43 Free Cash Flow 34.06 $226.fifteen NA $300.06 NA NA EBITDA xx.35 NA NA $178.87 $204.11 $233.62 EBIT (operating income) 21.33 $130.71 $155.85 $181.10 $209.89 $237.nineteen Average $179.95 $201.70 $222.28 $266.07 $315.79 $199.61 Current Price $195.58 -8.69% 3.03% 12.01% 26.49% 38.07% two.02% Upside To Fair Value -vii.99% 3.13% 13.65% 36.04% 61.47% two.06% 2021 PE 2022 PE 2022 Weighted EPS 12-Month Forward EPS 12-Month Average Fair Value Frontward PE $five.91 $seven.08 $half dozen.40 $half-dozen.97 28.six 28.1

Visa is trading at 28.1X forward earnings, slightly below its average trimmed harmonic fair value of 28.6X.

What does that actually mean?

12-Calendar month Frontward Fair Value Upside To Fair Value (Not Including Dividends)

Rating Margin Of Safety For 13/13 Ultra SWAN Quality Companies 2021 Price 2022 Price Potentially Reasonable Purchase 0% $179.95 $201.seventy $199.61 Potentially Good Buy 5% $170.95 $191.61 $189.63 Potentially Strong Buy 15% $152.96 $171.44 $169.66 Potentially Very Strong Buy 25% $128.21 $151.27 $149.70 Potentially Ultra-Value Buy 35% $116.97 $131.10 $129.74 Currently $195.58 -8.69% 3.03% 2.02% -7.99% 3.13% ii.06%

That for anyone comfortable with its risk profile, Visa is a potentially reasonable buy. And here's why.

Reason Five: Marketplace Smashing Full Return Potential In Both The Short And Long-Term

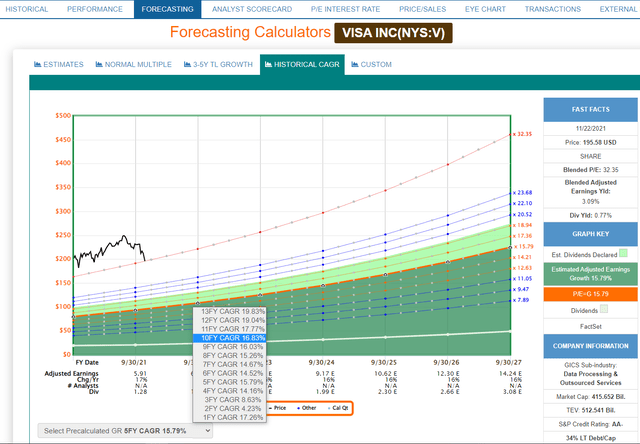

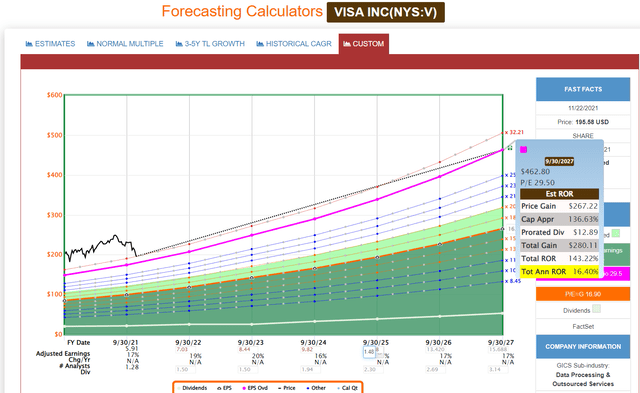

Hither's what investors buying Visa today can reasonably expect.

- v-yr consensus render potential range: 14% to xx% CAGR

Visa 2023 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research)

(Source: FAST Graphs, FactSet Research)

Visa 2026 Consensus Full Return Potential

(Source: FAST Graphs, FactSet Research)

(Source: FAST Graphs, FactSet Research)

Over the side by side five years, analysts expect 21% returns from the Due south&P 500 and potentially 140% from Visa, 7X meliorate consensus return potential.

Visa Investment Decision Score

First-class

Ticker v DK Quality Rating thirteen 87% Investment Form A Sector Applied science Safety five 94% Investment Score 95% Industry IT Services Dependability 5 78% five-Yr Dividend Return v.88% Sub-Manufacture Data Processing & Outsourced Services Business Model 3 Today's 5+ Year Risk-Adjusted Expected Return 12.23% Ultra SWAN, Phoenix, Hyper-Growth, Strong ESG Goal Scores Scale Interpretation Valuation 3 Reasonable Buy v'southward 2.02% discount to off-white value earns information technology a 3-of-4 score for valuation timeliness Preservation of Uppercase 7 Excellent v's credit rating of AA- implies a 0.55% chance of bankruptcy hazard, and earns it a 7-of-seven score for Preservation of Capital Return of Capital North/A Northward/A N/A Render on Capital 10 Exceptional v'south 12.23% vs. the South&P'southward 2.89% 5-twelvemonth risk-adjusted expected return (RAER) earns it a x-of-10 Return on Capital score Total Score 20 Max score of 21 Due south&P'southward Score Investment Score 95% 73/100 = C(Market place Boilerplate) Investment Alphabetic character Grade A

(Source: DK Automated Investment Conclusion Tool)

For those comfortable with its hazard profile, Visa is i of the best hyper-growth blue-chips you can buy in today'due south 30% overvalued market place.

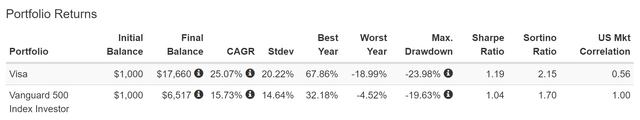

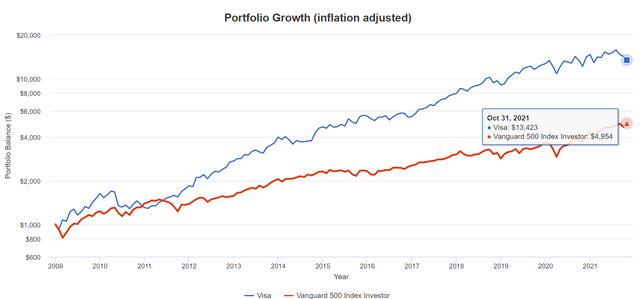

Visa Full Returns Since 2009

(Source: Portfolio Visualizer)

(Source: Portfolio Visualizer)

- yield in 2009: 0.8% (same as today)

- the yield on cost 2021: x.vii%

- income growth (including dividend reinvestment): 24.1% CAGR

Visa S&P 500 Vs Aristocrats Inflation-Adapted Long-Term Return Forecast: $1,000 Investment

- the bond market is pricing in 2.35% inflation for the next 30 years

- three.one% for the next 5 years

Time Frame (Years) 7.55% CAGR Aggrandizement-Adapted S&P Consensus 8.85% Aggrandizement-Adjusted Aristocrat Consensus 14.55% CAGR Visa consensus Divergence Between Visa And S&P v $1,438.97 $ane,528.07 $i,972.31 $533.34 ten $two,070.64 $ii,334.99 $3,890.01 $1,819.37 15 $2,979.59 $3,568.01 $7,672.31 $4,692.73 20 $4,287.54 $5,452.16 $15,132.xix $10,844.65 25 $6,169.65 $eight,331.26 $29,845.40 $23,675.75 thirty $8,877.94 $12,730.72 $58,864.41 $49,986.47 35 $12,775.11 $19,453.38 $116,098.95 $103,323.84 xl $18,383.01 $29,726.06 $228,983.26 $210,600.26 45 $26,452.62 $45,423.39 $451,626.28 $425,173.67 l $38,064.55 $69,409.94 $890,747.63 $852,683.08

Time Frame (Years) Ratio Aristocrats/Due south&P Ratio Visa Vs S&P 500 five ane.06 one.37 10 1.13 1.88 15 1.twenty 2.57 xx 1.27 3.53 25 1.35 4.84 xxx 1.43 half dozen.63 35 1.52 9.09 40 1.62 12.46 45 one.72 17.07 50 ane.82 23.forty

Combining Visa with loftier-yield Ultra SWANs like MMP can deliver prophylactic income today, and a rich retirement tomorrow.

- 3 Ways eight.nine% Yielding Magellan Midstream Can Help You lot Retire Rich

Company Ticker Yield Growth Consensus Long-Term Consensus Total Return Potential Weighting Weighted Yield Weighted Growth Weighted Total Return Potential Bourgeois Chance-Adapted Expected Return Altria MO 8.18% 5.3% 13.five% 0.00% 0.0% 0.0% 0.0% nine.44% Amazon AMZN 0.00% 23.ii% 23.2% 0.00% 0.0% 0.0% 0.0% 16.24% British American BTI 8.62% 4.2% 12.8% 0.00% 0.0% 0.0% 0.0% viii.97% Magellan Midstream Partners (K-i Tax Form) MMP 8.78% 5.4% fourteen.2% 50.00% four.four% 2.7% 7.ane% 9.92% Meta Platforms FB 0.00% 17.6% 17.vi% 0.00% 0.0% 0.0% 0.0% 12.32% Enbridge (CA Visitor, xv% Taxation Withholding) ENB vi.83% viii.4% 15.ii% 0.00% 0.0% 0.0% 0.0% 10.66% Philip Morris International PM 5.57% 11.eight% 17.4% 0.00% 0.0% 0.0% 0.0% 12.sixteen% Alphabet GOOG 0.00% 21.9% 21.9% 0.00% 0.0% 0.0% 0.0% 15.33% Visa V 0.77% 16.5% 16.9% 50.00% 0.iv% 8.3% 8.five% eleven.83% Mastercard MA 0.55% 22.1% 22.ane% 0.00% 0.0% 0.0% 0.0% 15.47% Starbucks SBUX 1.76% xi.0% 11.0% 0.00% 0.0% 0.0% 0.0% 7.70% Docusign DOCU 0.00% 50.0% 50.0% 0.00% 0.0% 0.0% 0.0% 35.00% Paypal PYPL 0.00% 21.6% 21.6% 0.00% 0.0% 0.0% 0.0% xv.12% Activision Blizzard ATVI 0.76% 12.4% 13.2% 0.00% 0.0% 0.0% 0.0% 9.21% Dividend Aristocrats NOBL 2.30% 8.ix% 11.two% 0.00% 0.0% 0.0% 0.0% 7.84% Nasdaq QQQ 0.68% 10.ix% 11.six% 0.00% 0.0% 0.0% 0.0% 8.11% Due south&P 500 VOO 1.forty% 8.5% 9.9% 0.00% 0.0% 0.0% 0.0% 6.93% 60/40 BAGPX 1.xc% v.1% 7.0% 0.00% 0.0% 0.0% 0.0% 4.90% The states Bonds SCHZ ane.30% 0.0% one.three% 0.00% 0.0% 0.0% 0.0% 0.91% Greenbacks VGSH 0.thirty% 0.0% 0.3% 0.00% 0.0% 0.0% 0.0% 0.21% Bitcoin BTC 0.00% lx.0% 35.0% 0.00% 0.0% 0.0% 0.0% 24.50% Ether ETH 0.00% 80.0% 50.0% 0.00% 0.0% 0.0% 0.0% 35.00% BlockFi USDC 9.00% 0.0% 9.0% 0.00% 0.0% 0.0% 0.0% 6.30% Full 49.69% 278.0% 325.0% 100.00% 4.8% 11.0% xv.5% 10.88%

(Source: DK Portfolio Construction Tool)

Visa + MMP offers a very safe four.8% yield, xi.0% overall growth, 15.8% consensus return potential, and xi.0% gamble-adjusted expected returns.

Long-Term Inflation And Hazard-Adapted Expected Returns

Investment Strategy Yield LT Consensus Growth LT Consensus Full Return Potential Long-Term Take chances-Adjusted Expected Return Safe Midstream 5.8% 6.ii% 12.0% 8.4% 6.1% Visa + MMP 4.8% 11.0% 15.8% 11.0% 8.7% Safe Midstream + Growth 3.iii% 8.five% xi.8% 8.three% five.9% REITs three.0% vii.0% 9.9% vi.9% 4.6% High-Yield 2.vii% 11.0% 13.7% nine.half-dozen% 7.2% Dividend Aristocrats 2.three% 8.nine% 11.2% 7.9% five.5% Value 2.1% 12.1% fourteen.2% ten.0% 7.vi% 60/40 Retirement Portfolio i.ix% 5.i% 7.0% 4.9% 2.six% REITs + Growth i.eight% 8.9% 10.6% 7.iv% five.ane% Loftier-Yield + Growth 1.7% eleven.0% 12.7% 8.9% 6.5% 10-Year Us Treasury 1.61% 0.0% ane.6% 1.half-dozen% -0.7% S&P 500 1.4% 8.v% nine.9% vi.ix% 4.6% Nasdaq (Growth) 0.7% 11.0% 11.7% eight.2% 5.8% Chinese Tech 0.iii% 14.0% 14.3% 10.0% 7.7%

(Sources: Morningstar, FactSet Research)

Higher safe yield than high-yield ETFs? Yep.

Faster growth than the Nasdaq? That's what analysts think.

Better risk-adapted returns than well-nigh whatsoever other investment strategy on Wall Street? You lot bet.

This is the Zen Phoenix strategy in action.

- Zen Phoenix: always buy growth with yield and yield with growth

- always at off-white value or better

- and always focusing on safety and quality first and audio risk management always

- balance in all things that matter (condom, quality, risk management, yield, growth, and value)

But before you get too excited about Visa just call up that even the world's highest quality Ultra SWANs however have a risk contour you must be comfy with before investing.

Risk Profile: Why Visa Isn't Right For Everyone

At that place are no risk-free companies and no company is right for anybody. Y'all have to be comfy with the fundamental risk contour.

Visa Risk Profile Summary

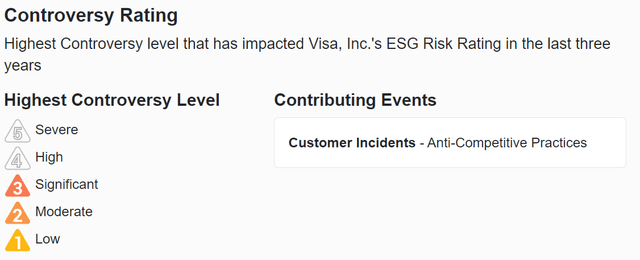

Visa's revenue is tied to the corporeality and volume of consumer purchases, which creates macroeconomic sensitivity. Both Visa and Mastercard have paid substantial fines historically related to the oligopolistic nature of the industry, and legal and regulatory take chances is intrinsic to the business model, given merchants' desires to lower fees. While Visa'south and Mastercard's positions in the electric current electronic payment industry are largely set, information technology continues to evolve in ways that could reduce their book or profitability. Some governments have shown a preference for local payment networks, which could freeze Visa out of certain markets and impede the value it drives from its global network.

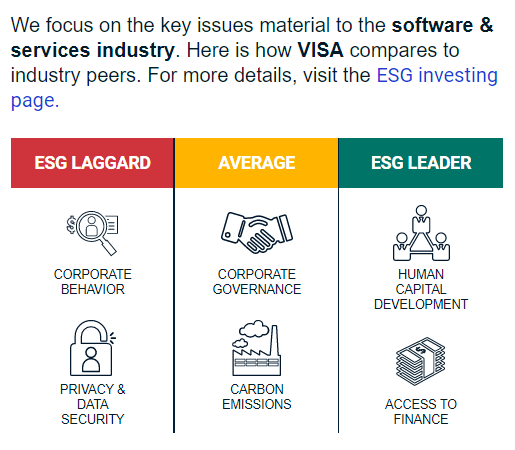

We see the visitor'south largest ESG chance as information security. Whatever company involved in processing payments has potential exposure to breaches in its systems." - Morningstar(emphasis added)

Visa'southward Gamble Contour Includes

- economic cyclicality risk (peculiarly cross border transactions, which are the almost profitable and thus impacted by the pandemic)

- regulatory risk (anti-trust concerns)

- disruption risk (370 major peers, Block-chain theoretically will permit 2X the chapters at 5% the cost...or less, Buy-now-pay after is another major disruption risk)

- M&A execution take chances (regulators might try to block Grand&A in the future, plus potentially overpaying for fast-growing fintechs)

- talent retention risk (tightest chore market place in over 50 years)

- data security chance: hackers and ransomware

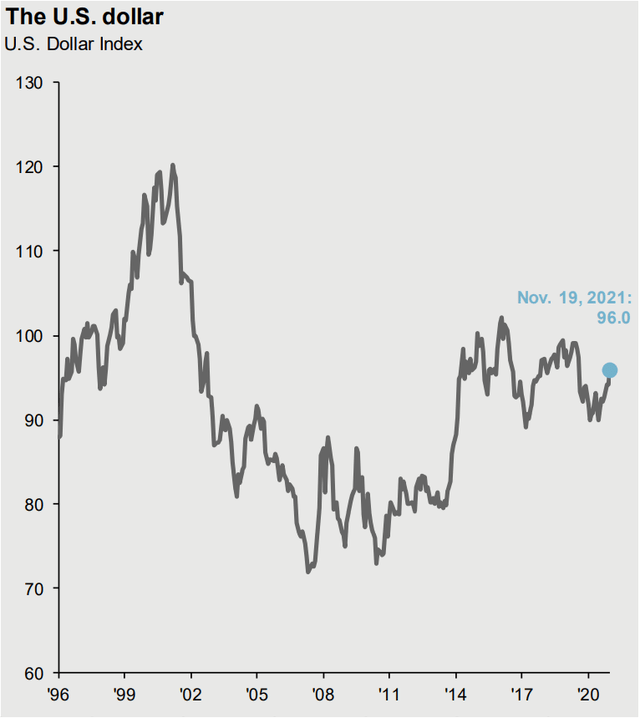

- currency take a chance (54% of sales exterior the United states of america)

Buy Now Pay Subsequently or BNPL is a newer example. But we remember we'll accept a similar outcome. While installments are fast-growing, there just a fraction of the total industry'south payment book is estimated to be well-nigh 100 to 150 billion. But we are bringing calibration to disruptors. Nosotros accept a two-pronged strategy where we provide a network solution likewise as solutions for our BNPL, Fintech partners...

We take nearly threescore crypto platform partners with the capability to event Visa credentials, and at that place -- nosotros're already capturing over three.v billion of payment volume in FY21....

Every bit a reminder, the boost we saw in Q3 was primarily from cryptocurrency purchases." - CEO, Q3 conference call

Visa has invested in and partnered with BNPL and crypto fintechs to ensure it gets a slice of whatever time to come pie they create.

(Source: JPMorgan Nugget Direction)

(Source: JPMorgan Nugget Direction)

How do nosotros quantify, monitor, and track such a circuitous risk profile? By doing what big institutions do.

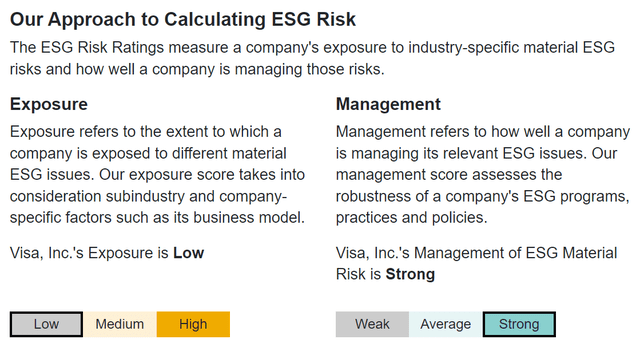

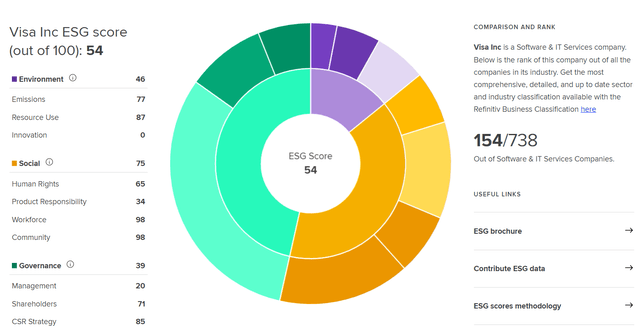

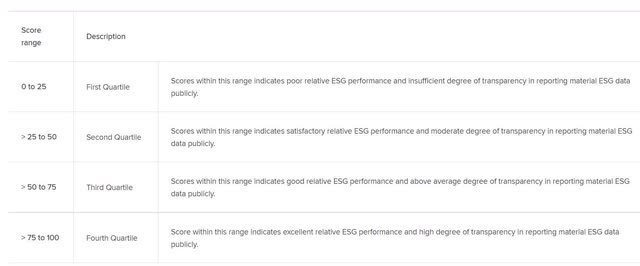

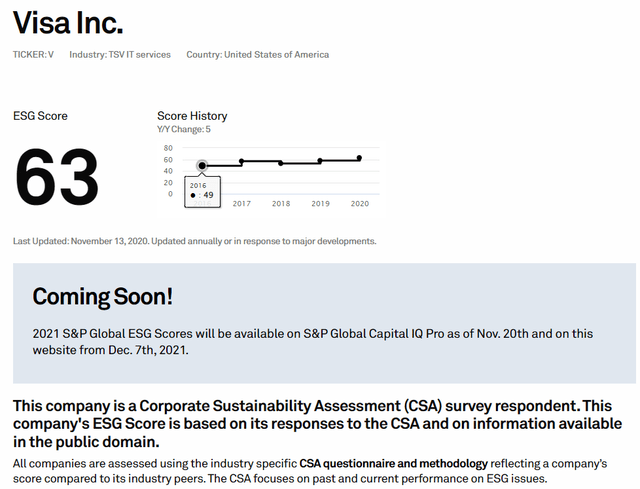

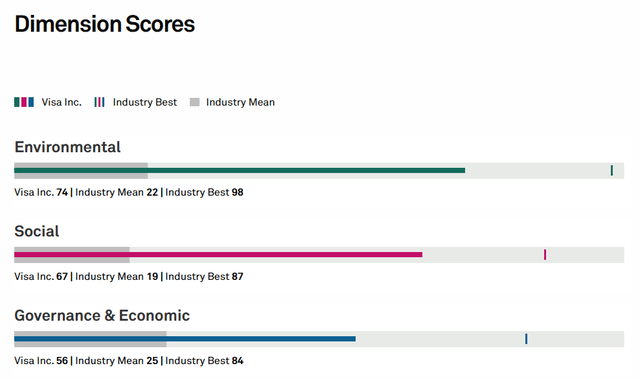

Material Financial ESG Run a risk Analysis: How Large Institutions Measure out Total Take chances

- iv Things You Need To Know To Turn a profit From ESG Investing

- What Investors Need To Know Near Company Long-Term Take chances Management (Video)

Hither is a special study that outlines the nigh important aspects of understanding long-term ESG financial risks for your investments.

- ESG is Non "political or personal ideals based investing"

- it'south total long-term risk direction analysis

ESG is but normal take chances by another name." Simon MacMahon, caput of ESG and corporate governance enquiry, Sustainalytics" - Morningstar

ESG factors are taken into consideration, aslope all other credit factors, when we consider they are relevant to and have or may have a material influence on creditworthiness." - Southward&P

ESG is a mensurate of risk, non of ethics, political definiteness, or personal opinion.

S&P, Fitch, Moody's, DBRS (Canadian rating agency), AMBest (insurance rating bureau), R&I Credit Rating (Japanese rating agency), and the Japan Credit Rating Agency have been using ESG models in their credit ratings for decades.

- credit and risk direction ratings make up 38% of the DK rubber and quality model

- dividend/residue sheet/risk ratings make up 79% of the DK safety and quality model

Dividend Aristocrats: 67th Industry Percentile On Gamble Management (Above-Average, Medium Risk)

(Source: Morningstar)

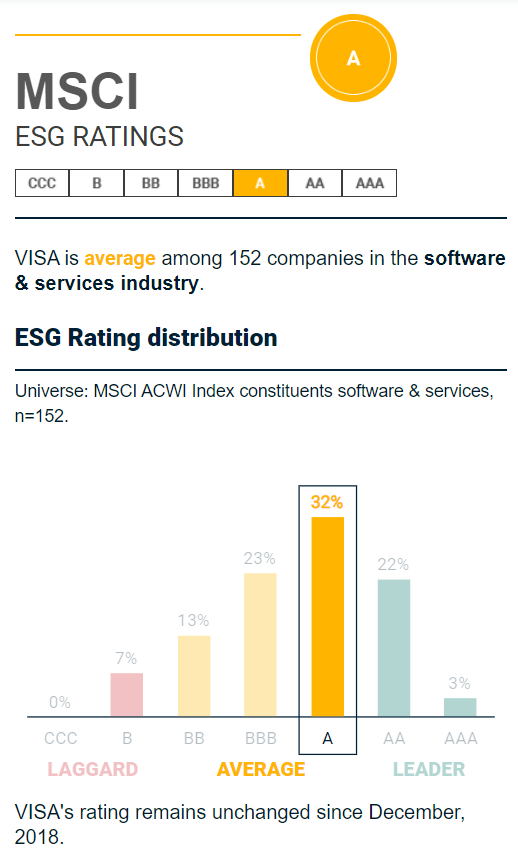

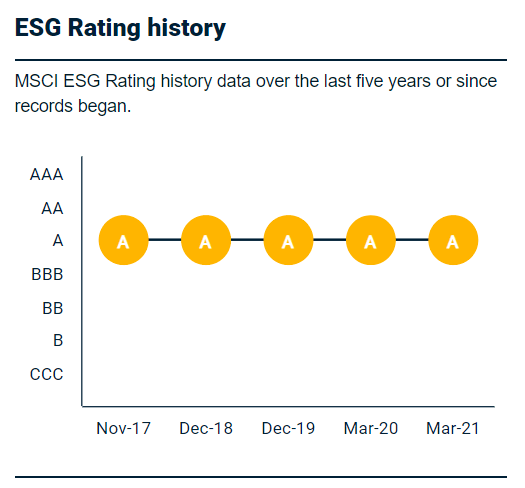

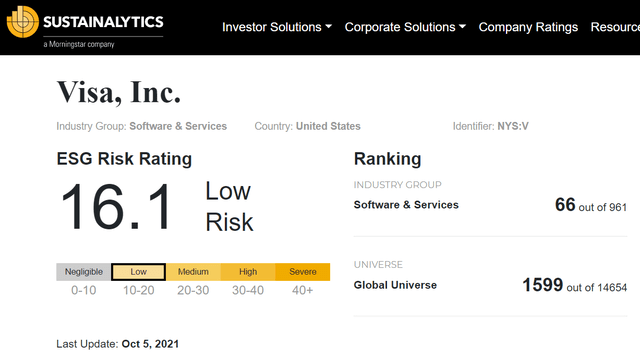

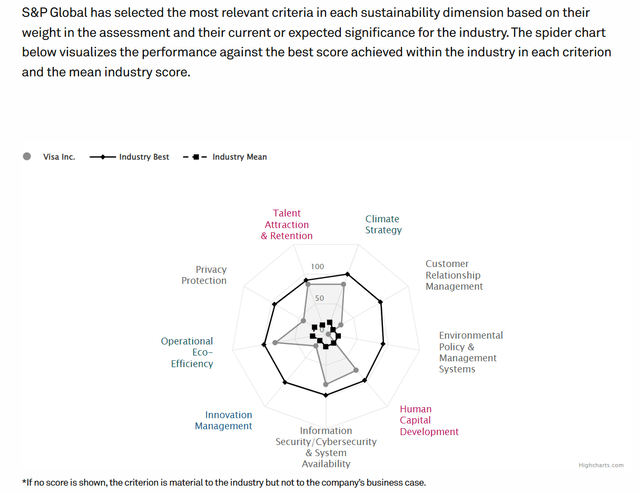

Visa Long-Term Risk Management Consensus

Rating Agency Nomenclature A, in a higher place-average 16.i/100 Depression-Risk

Rating Agency Industry Percentile MSCI 37 Metric Model 75.0% Morningstar/Sustainalytics 20 Metric Model 93.ane% Reuters'/Refinitiv 500+ Metric Model 79.1% Good South&P i,000+ Metric Model 63.0% Above-Average Just Capital 19 Metric Model 85.00% Excellent Consensus 79.1% Good FactSet Qualitative Assessment Below-Average Stable Tendency

(Sources: Morningstar, Reuters', S&P, Just Majuscule, FactSet Research)

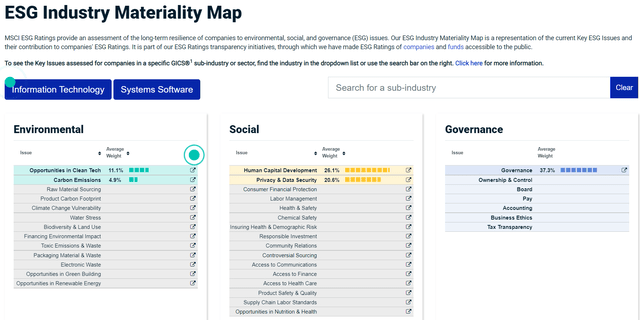

(Source: MSCI)

(Source: MSCI)

According to MSCI's 185 manufacture experts, 5 major risk factors are important to consider for this industry.

- environmental is only sixteen% of MSCI'due south weighting

- data security is more of import to Visa'southward run a risk profile than environmental concerns

- governance is #1 weighting for most ESG hazard models and that'south true for MSCI as well, at 37%

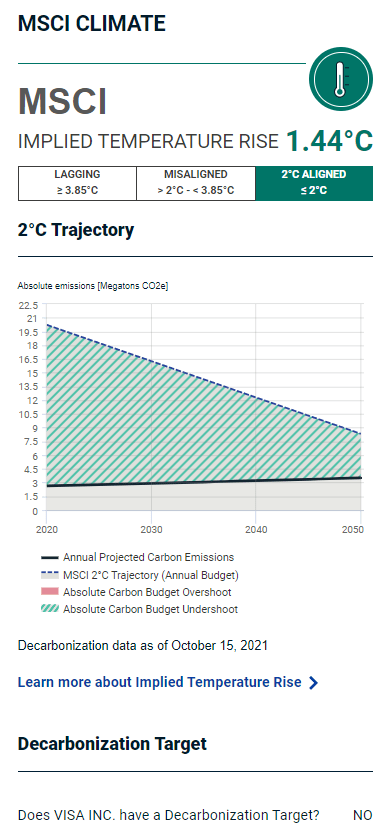

(Source: MSCI)

- MSCI is incorrect

- Visa has a target of becoming carbon-neutral by 2040

Implied Temperature Ascension compares the current and projected greenhouse gas emissions of nearly x,000 publicly listed companiestwo across all emissions scopes (based on the company's track record and stated reduction targets) with their share of the remaining global carbon budget for keeping warming this century well below 2 degrees Celsius (ii°C).3 A company projected to emit carbon beneath budget tin can exist said to "undershoot" the budget a company projected to exceed the budget "overshoots" it.

- telescopic i = a company's own emissions

- scope 2 = supply chain

- score three = end users

(Source: MSCI)

- scary headlines almost regulations or lawsuits? ESG adventure scores already measure it

(Source: Morningstar) - 20 metric model

- 93rd industry percentile

- 89th percentile among almost 15,000 globally rated companies

(Source: Reuters'/Refinitiv) - over 500 metric model

(Source: Reuters'/Refinitiv) - over 500 metric model

Reuters considers Visa's chance direction to be in the 79th industry percentile with an 85/100 general risk management (CSR strategy) which is splendid.

(Source: Due south&P)

S&P'due south gamble management model, which is included in all its credit ratings, uses publically available information for over 1,000 fundamental metrics, ranging from talent retentiveness/employee skill investments to supply chain management to occupational health and safety.

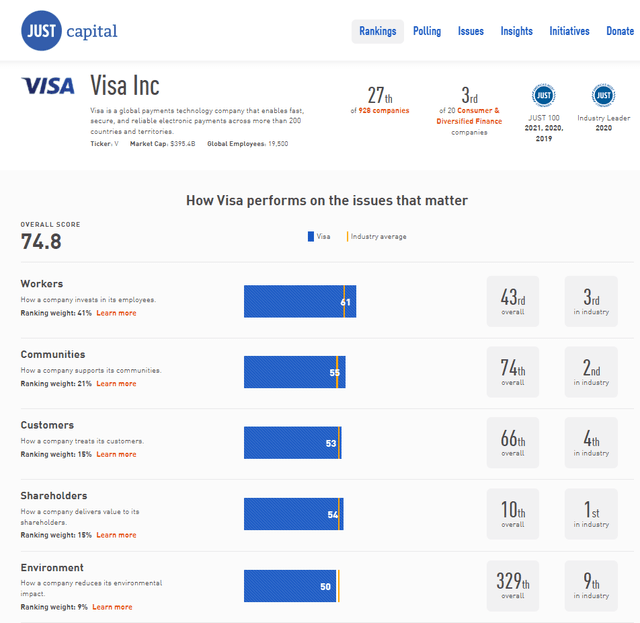

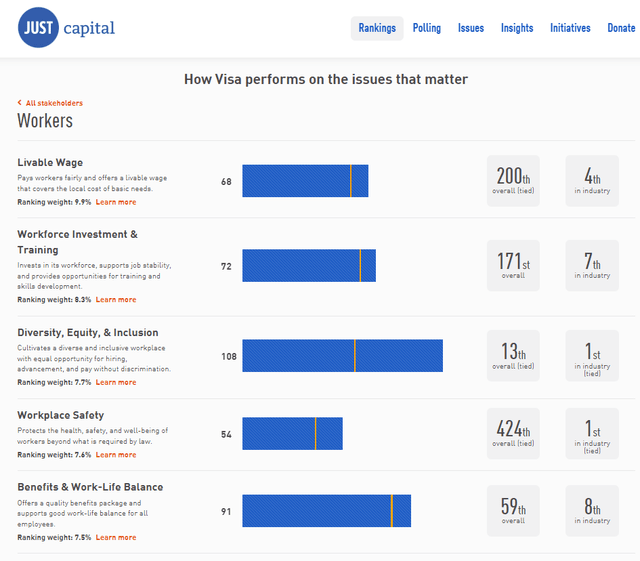

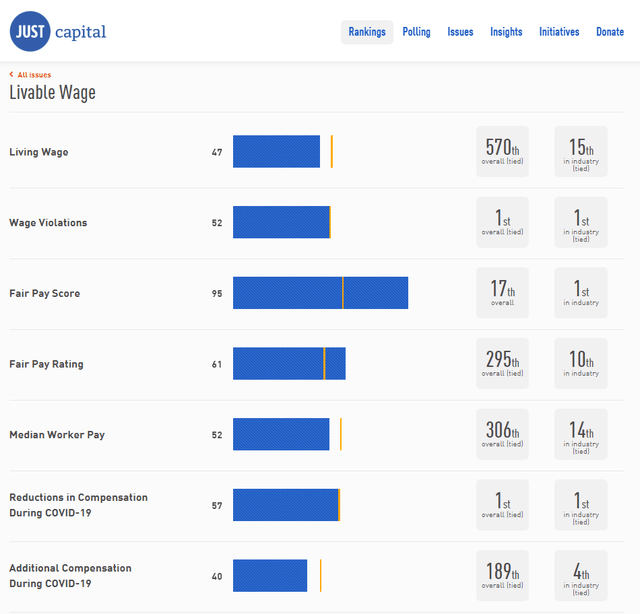

- Just Uppercase's rating is based on a survey of 110,000 Americans about which of 19 risk factors they consider almost of import for companies

- then using publically available data, they rank 928 of America'south largest companies

- 75 total sub metrics are used to summate these scores

(Source: Only Capital)

(Source: Only Capital)

- 85th industry percentile

- #1 in the industry in 2020

- Top 100 amidst American companies in 2019, 2020 and 2021

- 97 percentile among U.s.a. companies

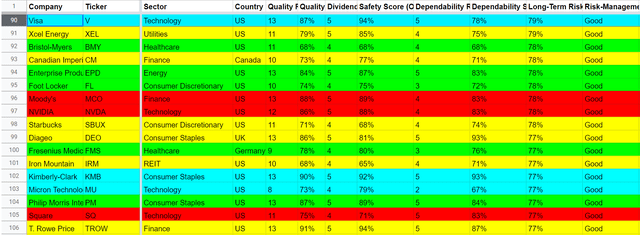

Visa'south Long-Term Risk Management Is The 82nd Best In The Principal List (82nd Percentile)

(Source: DK Master Listing) - 7 non-rated companies hateful Visa is in 82nd place

(Source: DK Master Listing) - 7 non-rated companies hateful Visa is in 82nd place

Visa'southward risk-management consensus is in the top eighteen% of the globe'south highest quality companies and similar to that of such other companies as

- T. Rowe Price (TROW) - dividend aristocrat

- Philip Morris International (PM) - dividend king

- Kimberly-Clark (KMB) - dividend aristocrat

- Diageo (DEO)

- NVIDIA (NVDA)

- Enterprise Products Partners (uses K-i taxation course) (EPD)

- Canadian Imperial Bank of Commerce (CM)

- Bristol-Myers (BMY)

The lesser line is that all companies accept risks, and Visa is good at managing theirs.

How We Monitor Visa'south Adventure Profile

- 37 analysts

- 2 credit rating agencies

- vii full risk rating agencies

- 44 experts who collectively know this business organization better than anyone other than management

- and the bond marketplace, the "smart money" on Wall Street

Rest assured, that if Visa'south thesis weakens, strengthens, or breaks entirely, we'll know about it and then will our members.

What Would Pause/Weaken The Thesis On Visa

- Dividend rubber falls to 40% or less (unsafe)

- growth consensus falls to less than 9.ii% for a year - would be removed from Phoenix listing (and get a "personal hold" for me)

- growth consensus stays less than 9.2% or less for one year, I'd consider selling fifty%

- growth consensus stays less than ix.2% or less for two years I'd consider selling the entire position

- Visa's role in any portfolio is to generate 10+% total returns, which requires at least 9.two% growth

When the facts modify, I change my mind. What do you practise sir?" - John Maynard Keynes

There are no sacred cows at Dividend Kings. Wherever the fundamentals pb we always follow. That'due south the essence of disciplined financial science, the math retiring rich and staying rich in retirement.

Bottom Line: This Carry Market place In Visa Is A Potentially Wonderful Long-Term Ownership Opportunity

Only because the market is 30% overvalued and potentially set for a very disappointing few years for stocks, doesn't mean that there aren't still amazing blue-scrap opportunities for smart investors to take advantage of.

Visa's recent bear market has finally brought it dorsum to fair value, making it a archetype Buffett-fashion "wonderful company at a fair cost".

One that could deliver almost 18% annualized long-term returns in the years and decades alee.

And if you combine information technology with high-yield blue-chips like MMP then you lot tin enjoy nearly 5% very prophylactic yield today, while waiting for potentially 16% long-term returns in the future.

Am I proverb that analysts are correct and Visa is set to soar 41% in the next twelvemonth? Absolutely not, that'south not at all justified past its fundamentals.

What I am saying is that Visa's consensus fundamentals betoken a 27% potential total render in the next ii years, and 143% in the side by side five years.

That'due south not just 7X more than the South&P 500 is expected to potentially deliver just could be but what your diversified and prudently gamble-managed portfolio needs to beat inflation today, retire rich tomorrow, and stay rich in retirement.

Are you tired of cursing the Fed for tape low-interest rates and tape-high stock prices?

Are yous sick of worrying about every marketplace gyration and trying to short-term trade your style to prosperity?

And then it's time to stop praying for luck on Wall Street, and starting time making your ain.

Luck is what happens when preparation meets opportunity." - Roman philosopher Seneca the younger

Buying Visa before it fell 22% and was about twenty% overvalued, was non reasonable or prudent.

Ownership it now at fair value? That'south sound disciplined financial science and could prove to exist one of the all-time long-term dividend growth investments y'all ever brand.

Source: https://seekingalpha.com/article/4472219-5-reasons-to-buy-visa-before-everyone-else-does

0 Response to "Will Visa Stock Split Again 2018"

Post a Comment